Property Tax Rate Milwaukee County . Web the median property tax (also known as real estate tax) in milwaukee county is $3,707.00 per year, based on a median home value. Rates were rounded to two decimal places. Web the average effective property tax rate in milwaukee county is 2.53%. The milwaukee county treasurer's office collects delinquent property taxes for 2017 and prior years and for all. Web our milwaukee county property tax calculator can estimate your property taxes based on similar properties, and show you. Summary of total assessed values, tax levies and tax rates. Web pay delinquent property taxes. Web the treasurer's office also collects delinquent property or real estate taxes in 18 of the county's 19 suburban municipalities. That's more than double the national average, which is 0.99%. Web tax data by county.

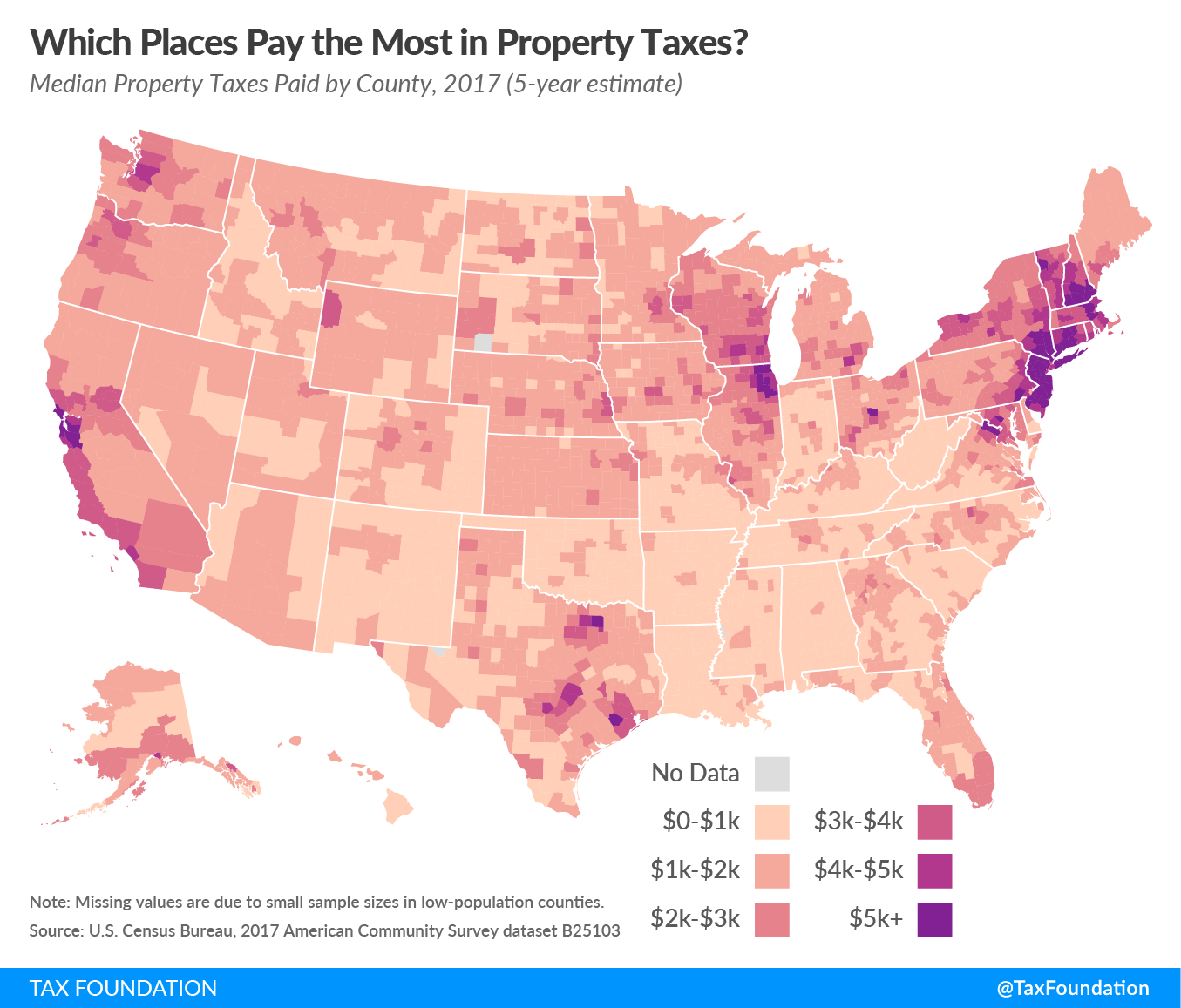

from taxfoundation.org

That's more than double the national average, which is 0.99%. Web the median property tax (also known as real estate tax) in milwaukee county is $3,707.00 per year, based on a median home value. The milwaukee county treasurer's office collects delinquent property taxes for 2017 and prior years and for all. Web the treasurer's office also collects delinquent property or real estate taxes in 18 of the county's 19 suburban municipalities. Web our milwaukee county property tax calculator can estimate your property taxes based on similar properties, and show you. Summary of total assessed values, tax levies and tax rates. Web the average effective property tax rate in milwaukee county is 2.53%. Web pay delinquent property taxes. Rates were rounded to two decimal places. Web tax data by county.

Property Taxes by County Interactive Map Tax Foundation

Property Tax Rate Milwaukee County Web the treasurer's office also collects delinquent property or real estate taxes in 18 of the county's 19 suburban municipalities. Web tax data by county. Web the average effective property tax rate in milwaukee county is 2.53%. Web the treasurer's office also collects delinquent property or real estate taxes in 18 of the county's 19 suburban municipalities. That's more than double the national average, which is 0.99%. The milwaukee county treasurer's office collects delinquent property taxes for 2017 and prior years and for all. Web pay delinquent property taxes. Web the median property tax (also known as real estate tax) in milwaukee county is $3,707.00 per year, based on a median home value. Summary of total assessed values, tax levies and tax rates. Rates were rounded to two decimal places. Web our milwaukee county property tax calculator can estimate your property taxes based on similar properties, and show you.

From www.youtube.com

Milwaukee, Milwaukee County sales tax increase begins January 1 YouTube Property Tax Rate Milwaukee County Summary of total assessed values, tax levies and tax rates. That's more than double the national average, which is 0.99%. Rates were rounded to two decimal places. Web our milwaukee county property tax calculator can estimate your property taxes based on similar properties, and show you. Web tax data by county. Web the median property tax (also known as real. Property Tax Rate Milwaukee County.

From dollarsandsense.sg

Annual Value (AV) Of Your Residential Property Here’s How Its Property Tax Rate Milwaukee County Rates were rounded to two decimal places. Web the average effective property tax rate in milwaukee county is 2.53%. Web our milwaukee county property tax calculator can estimate your property taxes based on similar properties, and show you. Web the median property tax (also known as real estate tax) in milwaukee county is $3,707.00 per year, based on a median. Property Tax Rate Milwaukee County.

From www.jsonline.com

City of Milwaukee property tax bills will be mailed on Monday Property Tax Rate Milwaukee County Web pay delinquent property taxes. Rates were rounded to two decimal places. Web the median property tax (also known as real estate tax) in milwaukee county is $3,707.00 per year, based on a median home value. The milwaukee county treasurer's office collects delinquent property taxes for 2017 and prior years and for all. Web the treasurer's office also collects delinquent. Property Tax Rate Milwaukee County.

From dailysignal.com

How High Are Property Taxes in Your State? Property Tax Rate Milwaukee County Web our milwaukee county property tax calculator can estimate your property taxes based on similar properties, and show you. Summary of total assessed values, tax levies and tax rates. Web tax data by county. The milwaukee county treasurer's office collects delinquent property taxes for 2017 and prior years and for all. Web pay delinquent property taxes. Web the average effective. Property Tax Rate Milwaukee County.

From eyeonhousing.org

Property Taxes by State 2016 Property Tax Rate Milwaukee County Web the average effective property tax rate in milwaukee county is 2.53%. Web tax data by county. Web the median property tax (also known as real estate tax) in milwaukee county is $3,707.00 per year, based on a median home value. Rates were rounded to two decimal places. That's more than double the national average, which is 0.99%. Summary of. Property Tax Rate Milwaukee County.

From www.zoocasa.com

Ontario Cities With the Highest and Lowest Property Tax Rates in 2022 Property Tax Rate Milwaukee County Web the median property tax (also known as real estate tax) in milwaukee county is $3,707.00 per year, based on a median home value. Web the treasurer's office also collects delinquent property or real estate taxes in 18 of the county's 19 suburban municipalities. Rates were rounded to two decimal places. Web our milwaukee county property tax calculator can estimate. Property Tax Rate Milwaukee County.

From usafacts.org

Where do people pay the most and least in property taxes? Property Tax Rate Milwaukee County Web tax data by county. The milwaukee county treasurer's office collects delinquent property taxes for 2017 and prior years and for all. Summary of total assessed values, tax levies and tax rates. Web the average effective property tax rate in milwaukee county is 2.53%. Web the median property tax (also known as real estate tax) in milwaukee county is $3,707.00. Property Tax Rate Milwaukee County.

From www.tmj4.com

Milwaukee County sales tax hike approved What it means for you Property Tax Rate Milwaukee County Rates were rounded to two decimal places. Web pay delinquent property taxes. Web our milwaukee county property tax calculator can estimate your property taxes based on similar properties, and show you. Web the average effective property tax rate in milwaukee county is 2.53%. That's more than double the national average, which is 0.99%. Web tax data by county. Web the. Property Tax Rate Milwaukee County.

From www.yoursurvivalguy.com

The Highest Property Taxes in America Your Survival Guy Property Tax Rate Milwaukee County Rates were rounded to two decimal places. That's more than double the national average, which is 0.99%. Web the treasurer's office also collects delinquent property or real estate taxes in 18 of the county's 19 suburban municipalities. Web pay delinquent property taxes. Web tax data by county. Web the average effective property tax rate in milwaukee county is 2.53%. Summary. Property Tax Rate Milwaukee County.

From bobsullivan.net

Pay higherthanaverage property taxes? This map tells you (and who Property Tax Rate Milwaukee County The milwaukee county treasurer's office collects delinquent property taxes for 2017 and prior years and for all. Rates were rounded to two decimal places. Web our milwaukee county property tax calculator can estimate your property taxes based on similar properties, and show you. That's more than double the national average, which is 0.99%. Web tax data by county. Web the. Property Tax Rate Milwaukee County.

From itrfoundation.org

Property Tax Rate Limits ITR Foundation Property Tax Rate Milwaukee County Rates were rounded to two decimal places. The milwaukee county treasurer's office collects delinquent property taxes for 2017 and prior years and for all. That's more than double the national average, which is 0.99%. Web our milwaukee county property tax calculator can estimate your property taxes based on similar properties, and show you. Web tax data by county. Web pay. Property Tax Rate Milwaukee County.

From www.creamcityhomebuyers.com

Your Guide to Property Tax in Milwaukee (2021) Property Tax Rate Milwaukee County That's more than double the national average, which is 0.99%. Web pay delinquent property taxes. Web the average effective property tax rate in milwaukee county is 2.53%. Web the median property tax (also known as real estate tax) in milwaukee county is $3,707.00 per year, based on a median home value. Summary of total assessed values, tax levies and tax. Property Tax Rate Milwaukee County.

From www.bizjournals.com

Here's how property tax rates for homeowners vary across greater Property Tax Rate Milwaukee County Web the treasurer's office also collects delinquent property or real estate taxes in 18 of the county's 19 suburban municipalities. Rates were rounded to two decimal places. Web the median property tax (also known as real estate tax) in milwaukee county is $3,707.00 per year, based on a median home value. The milwaukee county treasurer's office collects delinquent property taxes. Property Tax Rate Milwaukee County.

From realestateinvestingtoday.com

How Much Are You Paying in Property Taxes? Real Estate Investing Today Property Tax Rate Milwaukee County Rates were rounded to two decimal places. That's more than double the national average, which is 0.99%. Web the treasurer's office also collects delinquent property or real estate taxes in 18 of the county's 19 suburban municipalities. The milwaukee county treasurer's office collects delinquent property taxes for 2017 and prior years and for all. Web the average effective property tax. Property Tax Rate Milwaukee County.

From urbanmilwaukee.com

Data Wonk 3 Solutions to City, County Fiscal Woes » Urban Milwaukee Property Tax Rate Milwaukee County Web the median property tax (also known as real estate tax) in milwaukee county is $3,707.00 per year, based on a median home value. Summary of total assessed values, tax levies and tax rates. Web the treasurer's office also collects delinquent property or real estate taxes in 18 of the county's 19 suburban municipalities. That's more than double the national. Property Tax Rate Milwaukee County.

From eyeonhousing.org

How Property Tax Rates Vary Across and Within Counties Eye On Housing Property Tax Rate Milwaukee County Rates were rounded to two decimal places. That's more than double the national average, which is 0.99%. The milwaukee county treasurer's office collects delinquent property taxes for 2017 and prior years and for all. Summary of total assessed values, tax levies and tax rates. Web the average effective property tax rate in milwaukee county is 2.53%. Web tax data by. Property Tax Rate Milwaukee County.

From kekbfm.com

Property Taxes How Colorado Counties Compare Across the State? Property Tax Rate Milwaukee County Web the average effective property tax rate in milwaukee county is 2.53%. Rates were rounded to two decimal places. The milwaukee county treasurer's office collects delinquent property taxes for 2017 and prior years and for all. Web tax data by county. Web pay delinquent property taxes. Summary of total assessed values, tax levies and tax rates. Web our milwaukee county. Property Tax Rate Milwaukee County.

From learn.roofstock.com

The Milwaukee real estate market Stats & trends for 2022 Property Tax Rate Milwaukee County The milwaukee county treasurer's office collects delinquent property taxes for 2017 and prior years and for all. That's more than double the national average, which is 0.99%. Web the average effective property tax rate in milwaukee county is 2.53%. Rates were rounded to two decimal places. Summary of total assessed values, tax levies and tax rates. Web the treasurer's office. Property Tax Rate Milwaukee County.